AI and Financial Markets: How Algorithms Are Changing Investing

AI In Financial Markets Introduction

Let’s face it,investing can be confusing. You try to follow market trends, understand economic reports, watch crypto volatility, and still somehow miss the “buy low, sell high” memo. But what if I told you that right now, some of the smartest investors on Wall Street aren’t people, they’re algorithms?

Yep, welcome to the era where Artificial Intelligence (AI) is changing the way money moves.

From high-frequency trading to robo-advisors and AI-powered portfolio management, machines are no longer just calculating risks, they’re actively deciding where billions of dollars go each day.

Let’s unpack how AI is shaking up the financial markets, and what it means for investors like you and me.

Table of Contents

Why This Matters Now

Traditionally, investing was guided by:

- Gut instinct

- Historical data

- Expert analysis

- Hours of human research

But the modern financial world is faster and more volatile than ever:

- Markets react in milliseconds

- Data pours in from every direction (news, social media, earnings, war, politics)

- Human bias and emotions lead to bad decisions

This is where AI steps in:

- It doesn’t sleep

- It doesn’t panic

- It processes millions of variables in real time

- And it learns, improving with every trade

The result? A shift toward data-driven, emotion-free investing.

1. Algorithmic Trading: The Machines on the Trading Floor

Let’s start with the powerhouse: algorithmic trading (aka algo-trading).

These are AI-powered systems that:

- Execute trades based on complex rule sets

- Respond to market movements instantly

- Analyze massive datasets at speeds no human could

Key advantages:

- Faster execution = better prices

- No emotional trading

- Ability to exploit micro-opportunities (arbitrage, market inefficiencies)

Fun fact:

Today, over 70% of stock market volume in the U.S. is driven by algorithms.

Firms like Renaissance Technologies, Citadel, and Two Sigma have built empires on AI-powered trading.

2. Sentiment Analysis: Trading on Human Emotion (Ironically, With AI)

Markets aren’t just about numbers, they’re driven by sentiment.

AI can now:

- Analyze news headlines

- Scan social media posts

- Read earnings calls and analyst reports

- Detect patterns of panic or hype

Tools like:

- Bloomberg’s AI financial news engine

- Accern’s sentiment monitoring

- IBM Watson for Financial Services

They use natural language processing (NLP) to detect whether public sentiment is bullish, bearish, or somewhere in between, and act accordingly.

Example:

If a major tech CEO tweets something controversial, AI may detect potential impact before humans even react.

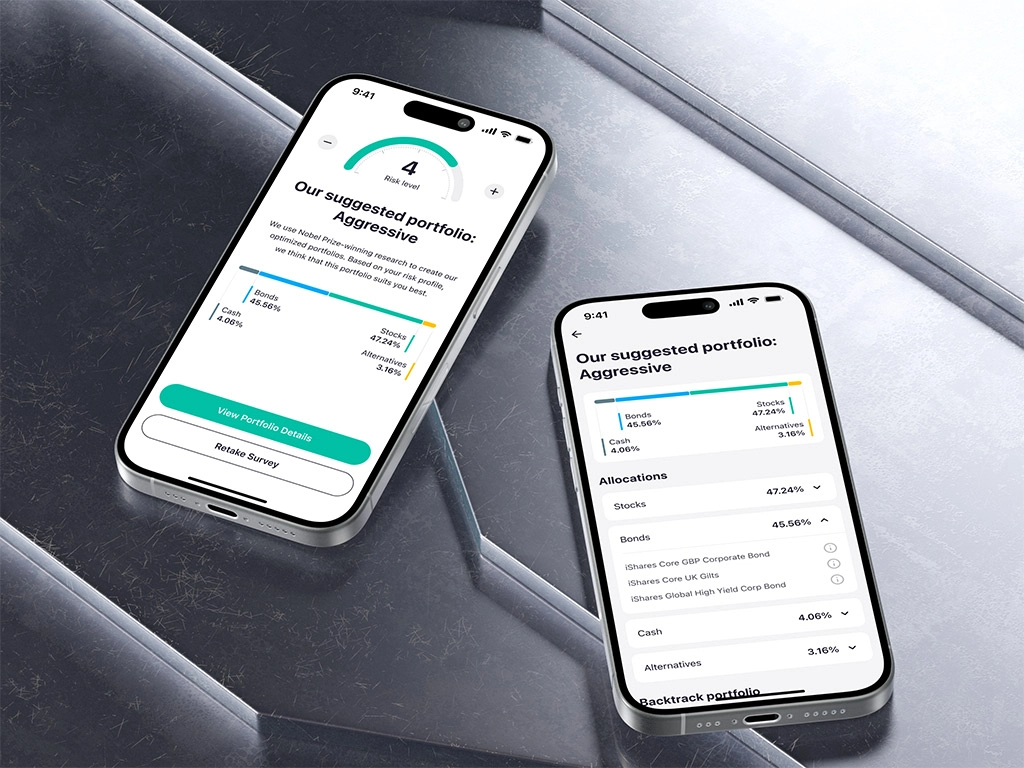

3. Robo-Advisors: Smart Investing for Everyday People

You no longer need a suit-and-tie financial advisor to get investment help.

Robo-advisors are AI-powered platforms that:

- Assess your risk tolerance

- Build a diversified portfolio

- Automatically rebalance investments

- Optimize for taxes and long-term goals

Popular platforms:

- Betterment

- Wealthfront

- SoFi Invest

- Schwab Intelligent Portfolios

Why it matters:

They offer low-cost, hands-off investing with personalized strategies, perfect for beginners, busy professionals, or anyone who’s not into staring at candlestick charts all day.

4. Portfolio Optimization: AI as Your Money Manager

Building the perfect portfolio isn’t easy. It requires balancing:

- Risk vs return

- Sector exposure

- Asset correlation

- Market timing

AI models like Monte Carlo simulations, mean-variance optimization, and machine learning regressions can:

- Simulate millions of scenarios

- Analyze real-time macro data

- Adjust allocations based on market shifts

Institutions use these tools to:

- Build resilient portfolios

- Reduce volatility

- Maximize gains with minimal drawdowns

Retail investors?

They now access similar features through tools like Ziggma, Alpaca, and QuantConnect.

5. Predictive Analytics: Forecasting the Market (Without a Crystal Ball)

No one can predict the future perfectly, but AI gets closer than most.

Using:

- Historical price data

- Technical indicators

- Macro-economic trends

- Social sentiment

AI can forecast potential price movements with a degree of statistical confidence.

Important note:

These are probabilities, not guarantees. But over time, AI-driven models can outperform human prediction by removing:

- Emotion

- Bias

- Inconsistent judgment

It’s not about winning every time, it’s about making better average decisions.

6. Fraud Detection & Risk Management: AI the Watchdog

In the financial world, security is everything.

AI helps institutions:

- Detect abnormal trading patterns

- Flag suspicious transactions (AML compliance)

- Monitor cybersecurity threats

- Run real-time credit scoring and risk models

Example:

Banks use AI to instantly detect a fraudulent trade that might have taken hours or days to flag manually.

For investors, this means safer platforms, smarter due diligence tools, and reduced exposure to financial crime.

7. High-Frequency Trading: The AI Arms Race

High-frequency trading (HFT) uses powerful algorithms to:

- Make thousands of trades per second

- Exploit minuscule market movements

- Profit on volume, not individual trade size

AI plays a huge role in:

- Signal generation

- Order routing

- Trade execution

This space is controversial. Critics say it creates unfair advantages, increases market volatility, and adds systemic risk. Supporters argue it increases liquidity and tightens bid/ask spreads.

But like it or not,HFT is here to stay, and AI is driving the speed.

8. Ethical Questions: Is AI in Investing Fair?

Important questions are emerging:

- Are AI-driven trades accessible only to big firms?

- Does this widen the gap between retail and institutional investors?

- Can AI be manipulated (e.g., via fake news)?

- Should there be regulation on autonomous trading?

We need transparency, regulation, and ethical frameworks to ensure the tech benefits everyone, not just the financial elite.

FAQ

Q1: Can AI guarantee profit in the market?

A1: Nope. AI improves probability and efficiency, not certainty. Markets are complex, and risk never disappears.

Q2: Should I trust robo-advisors over human advisors?

A2: They’re great for low-cost, passive investing. But if you need complex financial planning, human advisors still provide value.

Q3: Can beginners use AI in investing?

A3: Absolutely. Many platforms now offer AI tools tailored to novices,just start small, educate yourself, and stay cautious.

Final Thoughts & CTA

AI isn’t replacing investors, it’s evolving the role of the investor.

Whether it’s:

- Speeding up trades

- Analyzing market sentiment

- Automating your portfolio

- Detecting fraud

AI is helping us make smarter, faster, and more informed financial decisions.

The future of finance won’t be dominated by emotion or guesswork, it will be data-driven, algorithm-powered, and increasingly accessible.

Want to keep your money future-ready?

Stay with us at aihunterguides.com, where we decode the intersection of AI and finance, one algorithm at a time.

Pingback: How AI Is Transforming Customer Service in 2025